SCGC Records Almost 10% Jump in EBITDA for the Nine Months of 2016

Improved Revenues in Q3 Driving SCGC Success

Cairo, October 20, 2016. Today Suez Cement Group of Companies' (SCGC's) Board of Directors approved the consolidated financial report for the third quarter of 2016 (July-September). The Board also appointed Mr. José Maria Magrina, as new SCGC CEO. Prior to this appointment, Mr. Magrina headed Egypt’s Arabian Cement Company. He also served as CEO of Andalus Concrete ReadyMix.

Growth in Egypt’s cement market recovered in Q3 after a slow start on Q2. Overall, demand for cement jumped 8% between July and September versus the same period in 2015. The y-o-y increase was likely due in part to the Ramadan holiday last year, which typically results in lower construction material consumption. Cement prices continued to improve in Q3, following the previous quarter’s upward trend, rising 14% as compared to Q3 2015. On average, cement prices have remained largely stable over the last nine months versus 2015, climbing 1.9% versus 2015.

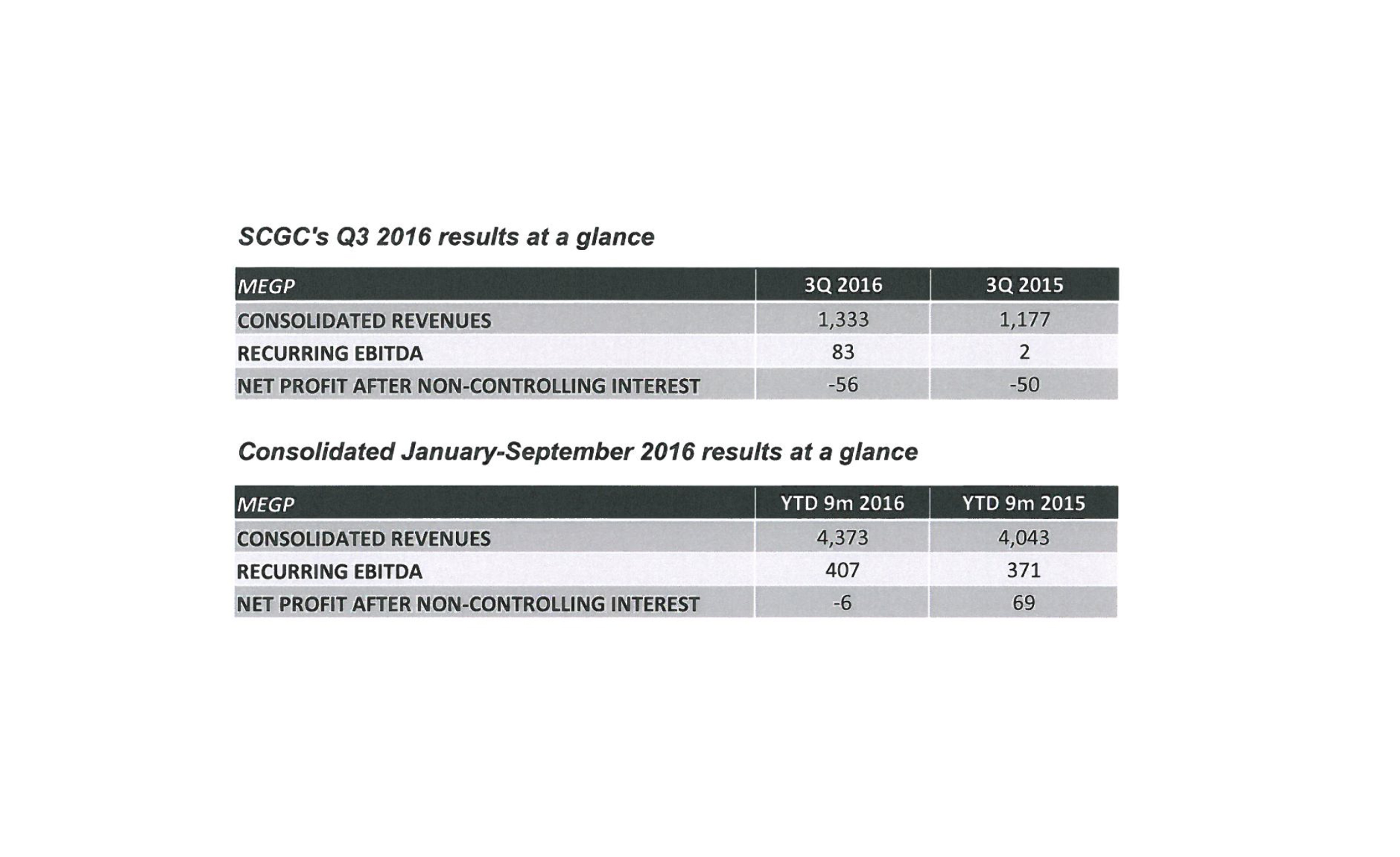

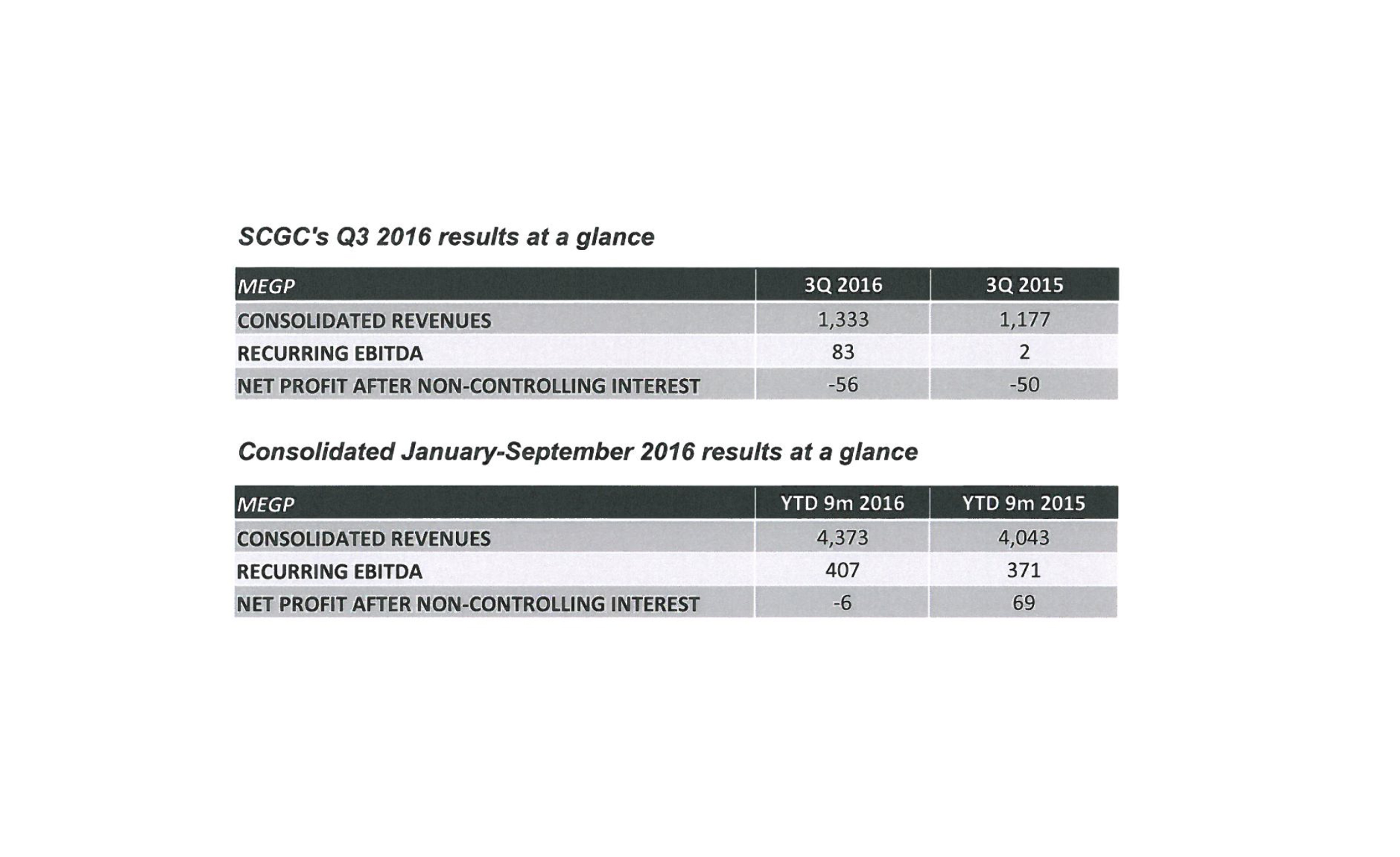

SCGC is proud to say the Company maintained its market share and position as an industry leader during the period. Group sales volumes increased 2% during the nine months of 2016. SCGC’s export sales also rose 7% in comparison to the same period last year. Furthermore, the Company’s consolidated revenues increased 13% in Q3 versus Q3 2015. SCGC’s Year to date consolidated revenues increased 8% versus the same period last year.

As a result of improved sales volumes, stable cement prices and SCGC’s aggressive strategies to improve internal efficiencies and diversify each plant’s energy mix, the Company succeeded in boosting its EBITDA between January and September by almost 10% versus the same period in 2015. However, SCGC reported a year-to-date net loss of EGP 6 million in terms of profits/losses after non-controlling interest due to significant pressure from foreign exchange rates and lower net financial income.

Outlook

SCGC maintains an optimistic outlook on cement production and sales during the remainder of 2016 and onwards since Egypt’s construction sector still embodies strong core fundamentals. However, recent measures to further restrict consumer credit and imports are expected to have a negative impact on economic growth overall. The continued shortage in foreign currency, which has not yet improved despite ongoing regulatory efforts, may worsen the country’s economic outlook in the near future.

Management believes Egypt will still move forward with implementation of several large national projects under the auspices of government stimulation initiatives designed to boost demand for cement. Construction has begun on some projects, but other initiatives have faced slower than anticipated launches due to economic uncertainty and financing restrictions.

SCGC is currently on track to implement its coal energy conversion project at the Helwan Plant, which is slated to be completed by the middle of next year. SCGC’s energy diversification program is focused on increasing the use of waste-derived fuels, petroleum coke, coal and renewable energy in order to prevent fluctuating natural gas and mazut prices from negatively impacting the Company’s bottom line. SCGC anticipates that its innovative energy program will continue to improve the Company’s manufacturing capacity as well as decrease operational and production overhead. The launch of coal and petroleum coke energy generation goes hand in hand with SCGC's focus on reducing its environmental impact through the implementation of state-of-the-art dust filter technology and streamlined manufacturing processes.

SCGC is also working to better serve domestic customers by shifting its strategy to service-oriented targets through customer satisfaction surveys, tailor-made product offerings, distribution centers, SCGC customer call centers, cement quality awareness sessions with customers and comprehensive technical assistance in addition to partnerships with leading cement consultants and academic institutions.

Downloads

SCGC Records Almost 10% Jump in EBITDA for the Nine Months of 2016 Improved Revenues in Q3 Driving SCGC Success.

Suez Cement

SCGC Records Almost 10% Jump in EBITDA for the Nine Months of 2016 Improved Revenues in Q3 Driving SCGC Success.

Suez Cement